State-Wise Road Tax in India: States with the Lowest & Highest Taxes

- 1Himachal Pradesh, Uttarakhand, and Goa offer the lowest road tax rates in India

- 2Karnataka, Maharashtra, and Telangana impose some of the highest road taxes on cars

- 3Road tax influences both the initial cost and resale value of your car

Did you know when buying a car in India, the price you see in ads is not the final cost? It's just the ex-showroom price or base price set by the manufacturer. The actual on-road price includes insurance, registration fees, and, most importantly, road tax in India. And here's the catch: road tax isn't the same everywhere.

Surprised? A car's final price can vary between ₹1-2 lakh, depending on where you register it! That's because each state has its own road tax, making some cities far more affordable than others.

In this article, we'll break down the state-wise road tax in India, highlighting the states with the lowest and highest taxation rates, and show you how road tax affects your total car cost.

What is road tax?

Road tax in India is a state-imposed tax that funds road maintenance and infrastructure. It is a one-time payment made at the time of vehicle registration and is calculated based on multiple factors.

Each state has its own rules for car tax in India. These charges are clubbed with other mandatory registration costs, known as RTO charges, forming the total payable amount. Here are the key factors and their impact on road tax:

| Factor | Impact on road tax |

| Ex-showroom price | Road tax is calculated as a percentage of the ex-showroom price, meaning higher-priced cars attract higher tax rates. For e.g., in Karnataka, road tax is 13% for cars under ₹5 lakh but increases to 18% for cars above ₹20 lakh. |

| Fuel type | Diesel cars are taxed higher than petrol cars in many states. In Maharashtra, for instance, a petrol car above ₹20 lakh is taxed at 13%, whereas a diesel car of the same price is taxed at 15%. |

| Engine capacity (CC) | Many states impose higher taxes on cars with larger engines. In Tamil Nadu and Telangana, vehicles with an engine capacity above 1500cc attract higher tax slabs. |

| State policies | Each state has its own taxation system—some follow a slab-based model (e.g., Karnataka and Maharashtra), while others have flat percentage rates (e.g., Delhi). This creates significant price differences between states. |

The state-wise road tax in India varies significantly; this makes it essential to know which states have higher or lower road taxes before buying a car.

States with the lowest road tax in India

There are some states that impose lower tax rates, which can significantly reduce the total tax on cars in India, making vehicle ownership more affordable. Whether due to government incentives or lower reliance on vehicle taxes for revenue, these states offer the cheapest road tax in India, ultimately lowering the on-road price for buyers.

Here are the states with the lowest on road tax in India:

Himachal Pradesh

Uttarakhand

Goa

Why do these states have the lowest road tax in India?

Key factors that lead to lower road tax:

- Government policies promoting car ownership

- Lower dependency on vehicle tax for revenue

- Less congestion and lower urban costs

Therefore, if you buy a car in these states, your overall on-road price will be lower, keeping your car's total cost significantly lower.

States with the highest road tax in India

While some states offer the lowest road tax in India, others impose higher taxation, significantly increasing the total tax on cars in India. If you're purchasing a vehicle in these states, expect a higher city on-road price, as road tax here is one of the major cost components.

Here are the states with the highest on road tax in India:

Karnataka

Maharashtra

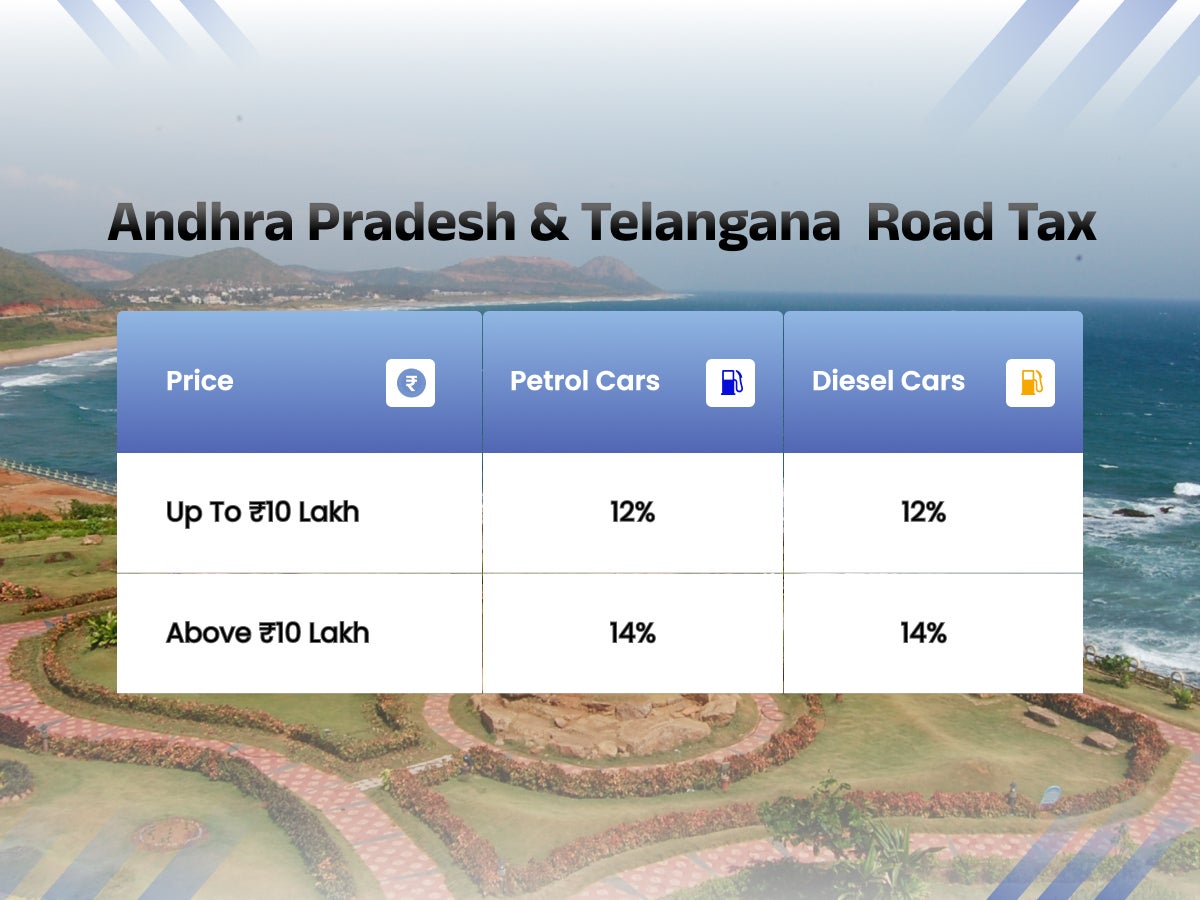

Andhra Pradesh & Telangana

Why do these states have the highest road tax in India?

Several factors contribute to the high on road car tax in India for these states:

- High vehicle density & urban infrastructure costs

- Policies discouraging excessive car ownership

- Additional taxation on luxury and high-end vehicles

If you're registering a car in these states, you may end up paying ₹1-2 lakh more than in states with the cheapest road tax in India. Understanding these costs helps you make an informed decision when buying a car.

How road tax impacts resale value

When it comes to selling a car, the state of registration plays a significant role—not just because it affects the initial on-road price, but also because it can influence the resale value. Cars registered in states with lower road tax tend to have a lower overall cost, which can make them more attractive to buyers. However, it's important to note that resale value is determined by a various factors, including market demand, the vehicle's condition, and depreciation over time.

Lower road tax can reduce the upfront cost, and in turn, potentially offer a resale advantage. Moreover, tax implications differ across various car categories and segments, impacting long-term ownership costs. For more detailed insights on how different car segments affect tax implications, check out our guide on car segments and their tax impact.

No matter where your car is registered, CARS24 ensures you receive the best resale price. With a nationwide dealer network, you can get an instant offer and sell your car hassle-free.

Ways to reduce your road tax burden

Looking for ways to lower your car tax in India? Here are some practical ways to cut costs:

Register in a low road tax state: If you have valid residence proof in that state, registering your car in a state with a low road tax in India can lead to substantial savings.

Choose a car with a smaller engine: Cars with lower engine capacity (CC) usually have lower road tax rates.

Consider an electric vehicle: Many states provide tax exemptions for electric vehicles (EVs), making them a more affordable option.

Plan your resale strategically: Cars registered in states with lower road taxes often have a higher resale value, as buyers consider the city's on-road price & long-term savings.

Smart decisions for better savings

Understanding road tax in India is the key to managing your car's total cost. Since state-wise road tax in India varies significantly, knowing where you'll pay the lowest road tax in India can help you save money. States like Jharkhand, Chandigarh, and Gujarat offer the cheapest road tax in India, while states like Karnataka & Maharashtra have some of the highest rates, impacting the city's on-road price.

If you're planning to buy a car, factoring in the total tax on cars in India can help you make an informed decision. Similarly, when selling a car, the state of registration plays a key role in its resale value, as buyers often prefer cars with lower tax liabilities.

When it's time to sell your car, CARS24 simplifies the process by offering the best price, no matter where your car is registered. With a hassle-free selling experience and instant payment, you can effortlessly turn your used car into cash.

Thinking of selling your car? Get the best price for your car with CARS24 today!

Frequently Asked Questions

Expand all