Can I Sell My Car which is on Loan?

- 1A seller is legally required to remove the hypothecation on the car’s RC before sale

- 2The seller can clear the outstanding amount or negotiate with buyer to do so

- 3Selling a car on loan can take up to 4 weeks or more to clear RTO processes

While selling a car on loan is possible, it takes patience, both on the seller’s and buyer’s sides. Before you can sell a car with a loan, you are legally required to receive a No Objection Certificate (NOC) from the financier and remove the hypothecation on the car's registration certificate (RC).

Only then can the car be legally transferred to its new owner. If you’re wondering how to sell a car with a loan, this article will explain the process and your alternative options for loan settlement on cars.

Can You Sell a Car That Is on Loan?

A car loan is an empowering instrument, as it allows one to purchase a vehicle utilising monthly instalments without needing to pay the full cost upfront. However, if you decide to sell your car on loan with an outstanding loan amount, the process to sell it takes a few extra steps. This includes clearing the outstanding amount, obtaining a NOC from the financier, removing the hypothecation on the car’s RC, selling the car and then transferring ownership to the next owner.

It is also possible that you, as a seller, can find a buyer for your car on finance before clearing the outstanding loan amount. This will require the buyer to be fully aware of the situation and patient since clearing the hypothecation with the RTO can take up to four weeks or more before the car’s title is clear.

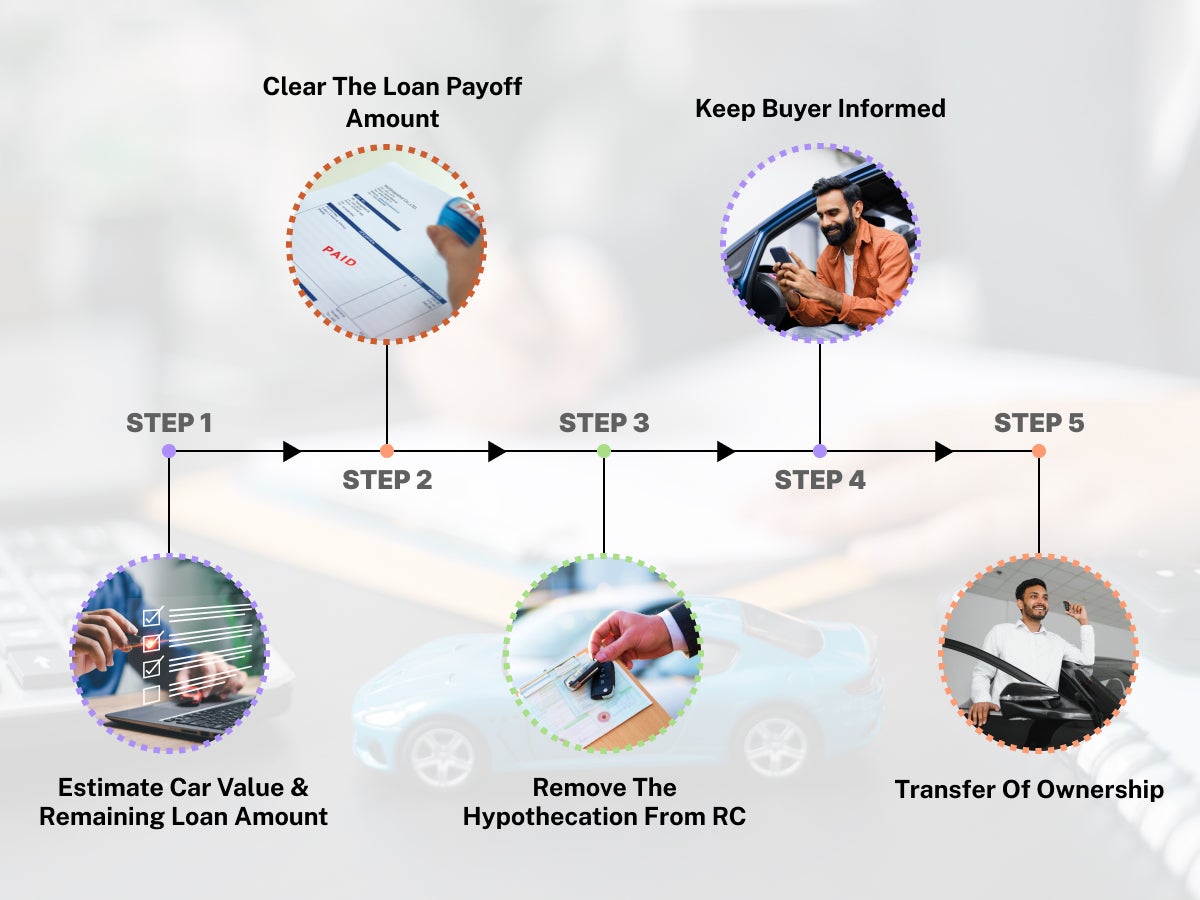

Step-by-Step Process for Selling a Financed Car

As mentioned, selling a car that is on loan requires additional steps before the sale can legally proceed. We’ve outlined the steps to sell a car with an outstanding loan below:

Estimate the Value of the Car and Outstanding Loan Amount

Getting an accurate idea of the value of your car on loan is of utmost importance when deciding to sell it. Scour used car classifieds, online listings, used car dealers and online used car value calculators to get your car’s market value. If the market value of your used car is higher than the outstanding loan amount, then you will make a profit from the sale.

If the market value is lower, then you incur a loss on the sale of your car on loan. Be sure to also get an accurate idea of the outstanding loan amount so that there are no surprises once the process starts. Keep in mind most financiers charge a penalty for early payoff of the loan or closure of the loan. When you sell your car with us, you can rest assured that you get the best price for your vehicle based on real-time market data rather than guesswork from classifieds or dealers.

Clear the Loan Payoff Amount

Speak to your financier and seek advice on the best way to pay the loan amount. Most financiers have procedures in place for just such a situation and you may be able to negotiate away from any penalties, or even bi-weekly or extra payments to foreclose the loan. You will have to clear the loan amount before the financier issues an NOC and a No Dues certificate. This is required to remove the hypothecation from the car’s RC.

Remove the Hypothecation from RC

Indian law states that it is mandatory to remove hypothecation from a car’s RC before its sale. The hypothecation is a declaration that your car has been offered as collateral against the loan from the financier. Removing the hypothecation signifies that the car is legally free of any dues or bounds to the financier.

You will need to submit the NOC from the financier along with two copies of Form 35 and other required documents to the relevant RTO for the removal of hypothecation. The process can take anywhere from two to four weeks to complete. Once your documents are ready, our process ensures that the sale of your car is completed quickly without unnecessary waiting periods.

Keep Buyer Informed

If you have already advertised your car on loan, honesty is the best policy. Keep the buyer of your used car informed of all proceedings, right from the repayment of loan amount to financier to the status of hypothecation removal at the RTO. Since the entire process can take time, it is important to keep the buyer in the loop to boost confidence in the sale and ensure a successful outcome. Through our Seller Protection Policy ‘Kavach’, you stay protected from unwanted challans or liabilities until the RC is fully transferred to the new buyer.

Transfer of Ownership

Once the hypothecation is removed from your car’s RC and ownership is legally transferred to your name, you can proceed with selling your car to its next owner. The rest of the sale process continues as when selling any used car.

Alternative Options for Selling a Car Under Loan

In the off-chance that you are not able to follow the steps above in selling your car on loan, there are a few options for selling a car with a loan:

Option 1: Transfer your car loan to another person

Some financiers may offer you the option of selling your car and transferring the outstanding loan to the buyer. For this, you will need to find a trusted buyer willing to take ownership of your loan before taking ownership of the car. Since it is not legally allowed to transfer ownership of a car under hypothecation, the buyer will not be listed as the legal owner of the car till the loan is paid off.

The buyer and seller must also reach an agreement on who will pay the pre-closure fees and charges in this case.

Option 2: Trade-in at a dealership

It may be possible to trade-in your car on loan at a dealership for another car, where the dealership takes over your loan. This is much less common because of the processes involved but each situation differs and you may find a dealership willing to extend this offer to you. You can sell your car to CARS24 where we not only settle the loan on your behalf but also complete the process at speed, so you can move on to your next car without delay.

Option 3: Sell to a private buyer and use the sale proceeds to pay off the loan

As a seller of a car on loan, another option is to find a buyer who is willing to pay you the required amount to clear the outstanding loan and then take ownership of the car. Once the loan is cleared and hypothecation removed, the ownership of the car can be legally transferred. This arrangement works when the seller is known to the buyer since there’s a high level of trust needed for a successful sale.

Legal and Financial Implications

We’ve already established that you cannot legally transfer ownership of a car to another person until the hypothecation is removed. Any workaround of this situation, as described above, requires the buyer and seller to have a high level of trust between them. If the seller is not forthcoming with the details of the car loan outstanding, he can be held responsible by law for any further financial implications such as penalty fees.

Tips for Selling a Car on Loan

To reiterate, the process of selling a car on loan is not as straightforward as selling a used car. Though several tips on selling a used car still apply, extra care must be taken to also involve the financier in the sale process.

Conclusion

Now that the process of selling a used car on loan is clearer, the question remains: should you sell a car that is on loan? The answer is situation-dependent — if you cannot manage to repay the loan on your car or if you didn’t plan the EMIs well using an EMI calculator, then selling your car is the smart way out.

Sure, you may lose some money in the process but when the alternative is heavy penalties for non-payment and critical hits to your CIBIL score, it’s the better option. In case you want to upgrade your car, selling it even if it’s on loan is still a viable option. With CARS24, you get the fastest selling experience, the best market price for your car, and complete seller protection so that you never face legal or financial issues after handing over your vehicle.

Join the CARS24 official car community, AUTOVERSE for more insights, discussions and more.

Frequently Asked Questions

Expand all